SPONSORS

High Impact Capital Raising

Focus on the most relevant investors for an efficient capital raise

- Designed to efficiently and intelligently connect sophisticated allocators with relevant private market opportunities

- We deliver a focused capital-raising campaign on behalf of our GP clients by marketing to higher potential investors across both our proprietary and our partner networks

- Global investor coverage

- Focus areas:

- Funds

- Direct deals

- Secondaries

The TritonLake Advantage

Expertise

Leadership team with a proven track record across a broad range of asset classes and disciplines including capital raising, FinTech, and RegTech

Technology

We believe that by leveraging technology we can revolutionize the way that sophisticated investors allocate to private markets and alternatives

Service

With dedicated relationship management, marketing advisory services, and institutional pipeline reporting – we extend your team and market reach

Investor Focus

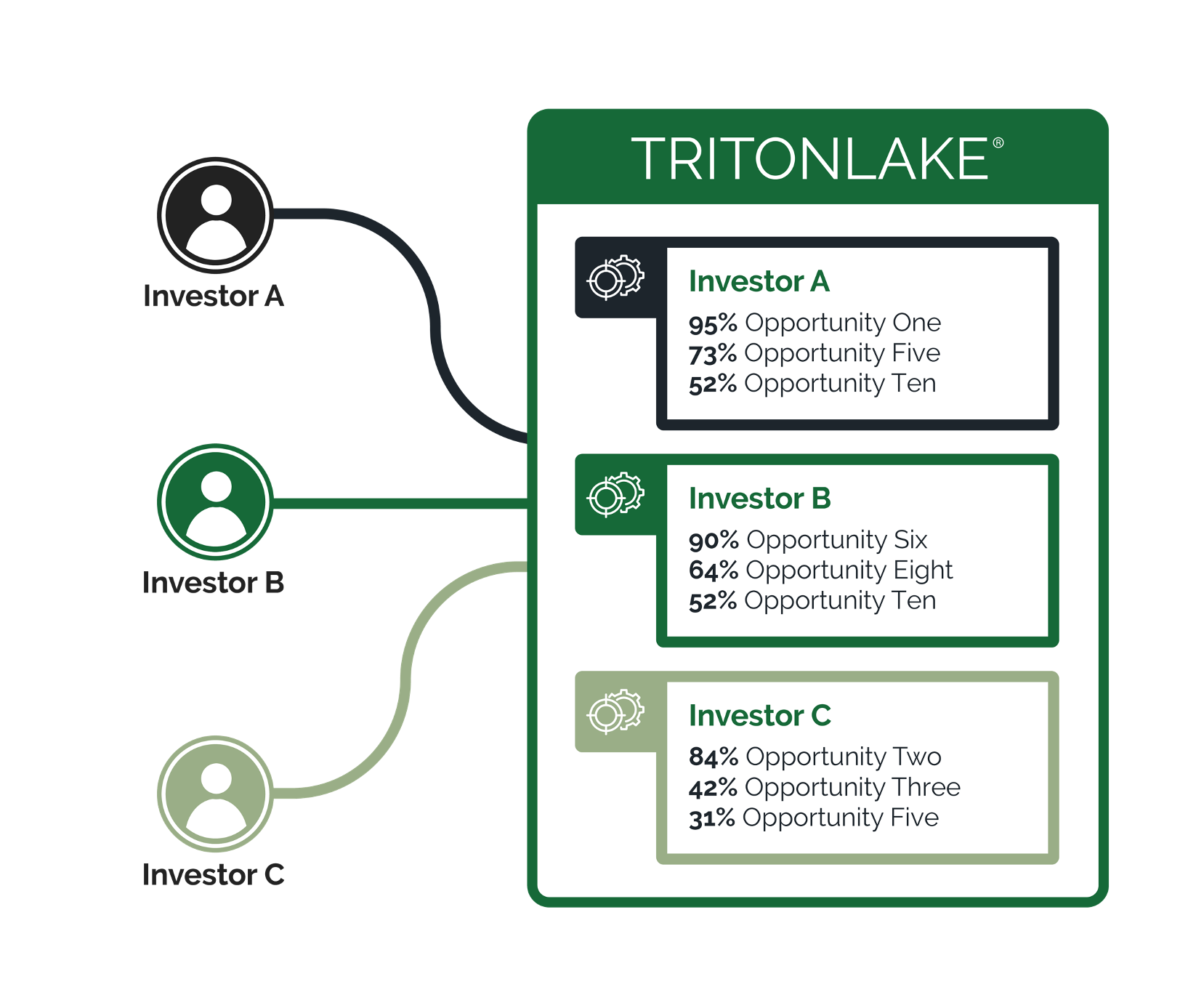

A thorough and behavioral finance-driven understanding of investor appetite enables us to deliver an extremely focused and efficient fundraising campaign

Focused Capital Raising

Investor Centric Delivery

- Our technology prioritizes opportunities most likely to be of interest and relevance based on both stated investment preferences and behavioral science (at an individual investor level)

- These opportunities are then shared via our web-based portal and email communications

- Relationship managers are available to support investors all the way through the process

TritonLake Matrix

- With TritonLake Matrix, GPs can amplify their distribution through our global network of partner placement agents

- Increase the likelihood of investment and broaden your LP base

- Access to multiple placement agents without any additional economics, through one relationship with TritonLake – with consolidated pipeline reporting across any agents that are engaged

Outcome: High Impact Capital Raising

Capital raising from TritonLake’s direct network of over 300 US investor entities with $5+ trillion in AUM (single and multi-family offices, OCIOS, fund-of-funds, and university endowments)

Target the right investors at the right time based on their preferences and behavior, all with institutional quality planning, pipeline reporting, and customer service

Access to TritonLake Matrix, our global network of like-minded placement agents speaking to pools of capital differentiated by geography and/or investor type

Interested in a highly focused and efficient capital-raising campaign?